100/2013: Approval of the Treasury Policy Statement, Treasury Management Strategy Statement, Prudential and Treasury Indicators, Minimum Revenue Provision (MRP) Policy and Investment Strategy. – 28 March 2014

Executive Summary and recommendation:

In line with legislation and CIPFA best practice formal approval is needed in relation to the above Treasury Management documents.

The strategies and information for consideration have been developed in line with best practice, and are consistent with the Medium Term Financial Plan (version 43).

Further information is provided in the main body of the report and accompanying appendices.

Police and Crime Commissioner decision:

The recommendations in Section 2 of this report are approved.

Signature Date 28 March 2014

Title Police & Crime Commissioner for North Yorkshire

Part 1 – Unrestricted facts and advice to the PCC

- Introduction and background

- The proposed treasury management strategy statement for 2014/15 and onwards is attached at Appendix A. This continues to focus on economy and stability, to achieve the lowest net interest rate costs recognising the risk management implications, and protect the annual revenue budget from short term fluctuations on interest rates.

- The proposed Treasury Management Policy Statement for 2014/15 and onwards is attached at Appendix B and covers the definition of treasury management activities and the key principles underpinning all treasury management activities. The definition includes the investment of surplus cash and the sourcing of external borrowing. The Commissioner’s average daily cash surplus, projected to be around £40m, is made up of the amounts held in balances, reserves and provisions, usable capital receipts, unapplied capital grants and temporary cash flow surpluses.

- The Chartered Institute of Public Finance and Accountancy (CIPFA) Prudential Code for Capital Finance in Local Authorities introduced new requirements for the manner in which capital spending plans are to be considered and approved. The Code was revised in November 2011 and includes a slight change to one of the key principles along with a requirement to incorporate the Commissioner’s high level policies for borrowing and investments within the Treasury Management Policy Statement.

- Prudential Indicators in respect of capital expenditure, external debt and treasury management activity are included at Appendix C. This includes the Authorised Limit for external borrowing required under section 3(1) of the Local Government Act 2003.

- Guidance requires the Commissioner to set an annual investment strategy. The proposed strategy is set out at Appendix D and has as its primary principle the security of investments.

- The criteria for choosing counterparties set out there provide a sound approach to investment in “normal” market circumstances. Whilst the Commissioner is asked to approve this base criteria, under the exceptional current market conditions the Commissioner’s Chief Finance Officer will temporarily restrict further investment activity to those counterparties considered of higher credit quality than the minimum criteria set out for approval. These restrictions will remain in place until the banking system returns to “normal” conditions. Similarly the time periods for investments will be restricted.

- The Department of Communities and Local Government (DCLG) has also issued statutory guidance setting out options for the way MRP may be calculated. Further background to the guidance and the policy is set out at Appendix E.

- One of the corner-stones of effective treasury management is the preparation and implementation of suitable Treasury Management Practices (TMPs), which set out the manner in which the organisation will seek to achieve the treasury management policies and objectives and prescribe how it will manage and control those activities. A summary of the current Treasury Management Practices relevant to the Commissioner is attached at Appendix F. Detailed schedules have also been prepared (not attached) which specify the systems and routines that are employed and the records that are maintained.

- Matters for consideration

The Commissioner is requested to approve the following for 2014/15 and onwards:- the Treasury Management Strategy set out in Appendix A;

- the Treasury Management Policy Statement at Appendix B;

- the Prudential and Treasury Indicators at Appendix C, including the Authorised Limit for external borrowing;

- the annual Investment Strategy at Appendix D

- the Minimum Revenue Provision (MRP) policy at Appendix E;

- the over arching Treasury Management Practices at Appendix F;

and to note the current approvals for counter parties and investment limits shown at Appendix G.

- Other options considered, if any

None - Contribution to Police and Crime Plan outcomes

- The requirement for production and monitoring of Prudential and Treasury Indicators ensures the Commissioner prudently manages alternative funding streams available to maintain an affordable and sustainable Business Development Plan (BDP). Although there is no direct impact on the Police and Crime Plan, effective Treasury Management ensures that the financial infrastructure is appropriate to underpin the resources available to deliver the service required.

- Consultations carried out

Not Applicable - Financial Implications/Value for money

- The Commissioner’s treasury portfolio position as at 25 March 2014 comprised:

Principal £m Average Rate % Fixed Rate Borrowing(North Yorkshire County Council) 472.0 9.15% Other long term liabilities Total 472.0 9.15% Investments 56.8m 0.424% - The fixed rate funding relates to a loan transferred from North Yorkshire County Council, which the Police Authority inherited when it separated out from the Local Authority. Although the interest rate of 9.15% is high in comparison to current market rates, the Authority did not seek to replace this at a lower rate, since it is part funded by annual grant covering 51% of the costs of the interest and debt management charge. The loan is due to be repaid in full on 31 March 2014.

- Balanced Budget Requirement

It is a statutory requirement under Section 33 of the Local Government Finance Act 1992 to produce a balanced budget. In particular, Section 32 requires a local authority to calculate its budget requirement for each financial year to include the revenue costs that flow from capital financing decisions.This means that capital expenditure must be limited to a level where increases in charges to revenue from additional external interest and running costs are affordable within the projected income levels for the foreseeable future.

- Budget Assumptions

The budget assumptions contained within this section are based on predicted movements on several variables. The investment interest receivable budget for 2014/15 is £200,000.

- The Commissioner’s treasury portfolio position as at 25 March 2014 comprised:

- Legal Implications

- The Commissioner uses Capita Asset Services Treasury Services as her external treasury management advisers. The company provides a range of services which include:

- Technical support on treasury matters, capital finance issues and the drafting reports;

- Economic and interest rate analysis;

- Debt services which includes advice on the timing of borrowing;

- Debt rescheduling advice surrounding the existing portfolio;

- Generic investment advice on interest rates, timing and investment instruments;

- Credit ratings/market information service comprising the three main credit rating agencies.

- It must be recognised that responsibility for treasury management decisions remains with the organisation at all times and will ensure that undue reliance is not placed upon our external service providers. Whilst the advisers provide support to the internal treasury function under current market rules and the CIPFA Code of Practice the final decision on treasury matters remains with the Commissioner. The Commissioner will ensure that the terms of their appointment and the methods by which their value will be assessed are properly agreed and documented, and subjected to regular review.

- The Commissioner uses Capita Asset Services Treasury Services as her external treasury management advisers. The company provides a range of services which include:

- Equality Implications

Not Applicable - Appendices:

Appendix A Treasury Management Strategy

Appendix B Treasury Management Policy Statement

Appendix C Prudential and Treasury

Appendix D Annual Investment Strategy

Appendix E The Minimum Revenue Provision (MRP) policy

Appendix F Treasury Management Practices

Appendix G Interest Rate Forecasts

Appendix H Current approvals for counterparties and investment limits

Public Access to Information

The Police and Crime Commissioner wishes to be as open and transparent as possible about the decisions he/she takes or are taken in his/her name. All decisions taken by the Commissioner will be subject to the Freedom of Information Act 2000 (FOIA).

As a general principle, the Commissioner expects to be able to publish all decisions taken and all matters taken into account and all advice received when reaching the decision. Part 1 of this Notice will detail all information which the Commissioner will disclose into the public domain. The decision and information in Part 1 will be made available on the NYPCC web site within 2 working days of approval.

Only where material is properly classified as restricted under the GPMS or if that material falls within the description at 2(2) of The Elected Local Policing Bodies (Specified Information) Order 2011 will the Commissioner not disclose decisions and/or information provided to enable that decision to be made. In these instances, Part 2 of the Form will be used to detail those matters considered to be restricted. Information in Part 2 will not be published.

Is there a Part 2 to this Notice – No

| Tick to confirm statement √ | |

|---|---|

| Director/Chief Officer has reviewed the request and is satisfied that it is correct and consistent with the NYPCC’s plans and priorities. | Gary Macdonald 005299 |

| Legal Advice Legal advice has been sought on this proposal and is considered not to expose the PCC to risk of legal challenge. | Simon Dennis 00363827 March 2014 |

| Financial Advice The CC CFO has both been consulted on this proposal, for which budgetary provision already exists or is to be made in accordance with Part 1 or Part 2 of this Notice | Jane Palmer 00436426 March 2014 |

| Equalities Advice An assessment has been made of the equality impact of this proposal. Either there is considered to be minimal impact or the impact is outlined in Part1 or Part2 of this Notice. | |

| I confirm that all the above advice has been sought and received and I am satisfied that this is an appropriate request to be submitted for a decision Jane Palmer 004364 Date 26 March 2014 |

Appendix A

Treasury Management Strategy as at 1 April 2014

The proposed strategy for 2014/15 and onwards is based upon treasury officers’ views on interest rates, supplemented by leading market forecasts provided by the Commissioner’s treasury advisor Capita Asset Services. The strategy covers:

- Policy on use of external service providers

- Treasury limits in force which will limit treasury risk and activities

- Prudential and Treasury Indicators

- The current treasury position

- The borrowing requirement and MRP Policy

- Prospects for interest rates and the economic background

- Creditworthiness policy

- The borrowing strategy

- Policy on borrowing in advance of need

- The investment strategy

The Local Government Act 2003 (the Act) and supporting regulations require the Commissioner to ‘have regard to’ the CIPFA Prudential Code and the CIPFA Treasury Management Code of Practice. The objectives of the codes are to ensure, within a clear framework and that Treasury management decisions are taken in accordance with good professional practice.

The code requires the Commissioner to determine her strategy for borrowing, and to prepare an annual investment strategy in accordance with guidance issued by the Department for Communities and Local Government (CLG). The investment strategy sets out policies for managing investments, giving priority to security and liquidity over yield. The code also requires the setting of Prudential and Treasury Indicators for the next three years, to ensure that capital investment plans are affordable, prudent and sustainable.

The DCLG has also issued statutory guidance setting out options for the way the minimum revenue provision (MRP) may be calculated. The method chosen requires the Commissioner’s approval and should be formalised in a Treasury management policy document.

CIPFA Requirements

CIPFA defines Treasury management as:

“The management of the Authority’s (Commissioner’s) investments and cash flows, its banking, money market and capital market transactions; the effective control of the risks associated with those activities; and the pursuit of optimum performance consistent with those risks”.

The primary requirements of the Code are as follows:

- Creation and maintenance of a Treasury Management Policy Statement which sets out the policies and objectives of the Commissioner’s treasury management activities.

- Receipt and approval of three main reports each year; the annual Treasury Management Strategy Statement (this report), including the prudential and treasury indicators, the annual Investment Strategy and Minimum Revenue Provision Policy; a mid-year Review Report and an Annual Report (stewardship report) covering activities during the previous year.

- Delegation, by the Commissioner, of responsibilities for implementing and monitoring treasury management policies and practices and for the execution and administration of treasury management decisions. This is set out in the Commissioner’s Financial Regulations.

- Creation and maintenance of Treasury Management Practices which set out the manner in which the Commissioner will seek to achieve those policies and objectives. Detailed schedules have been prepared which specify the systems and routines that are employed and the records that are maintained.

- During 2013/14 the Treasury Management Practices were amended by the Commissioner to include guidance as to the amounts to be invested for specific maturity periods, to represent a prudent balance between encouraging longer term investments (up to 12 months – and within the current Capita Asset Services recommendations) whilst maintaining access to invested funds.

Current Treasury Position

The Commissioner’s treasury portfolio position as at 25 March 2014 comprised:

| Principal £m | Average Rate % | |

|---|---|---|

| Fixed Rate Borrowing(North Yorkshire County Council) | 472.0 | 9.15% |

| Other long term liabilities | ||

| Total | 472.0 | 9.15% |

| Investments | 56.8m | 0.424% |

The fixed rate funding relates to a loan transferred from North Yorkshire County Council, which the former Police Authority inherited when it separated out from the Local Authority. Although the interest rate of 9.15% is high in comparison to current market rates, the Commissioner has not sought to replace this at a lower rate, since it is part funded by annual grant covering 51% of the costs of the interest and debt management charge.

Balanced Budget Requirement

It is a statutory requirement under Section 33 of the Local Government Finance Act 1992 for the Commissioner to produce a balanced budget. In particular, Section 32 requires a local authority (Commissioner) to calculate its budget requirement for each financial year to include the revenue costs that flow from capital financing decisions.

This means that capital expenditure must be limited to a level where increases in charges to revenue from additional external interest and running costs are affordable within the projected income of the Commissioner for the foreseeable future.

Budget Assumptions

The budget assumptions contained within this section are based on predicted movements on several variables. The investment interest receivable budget for 2014/15 is estimated at £200,000.

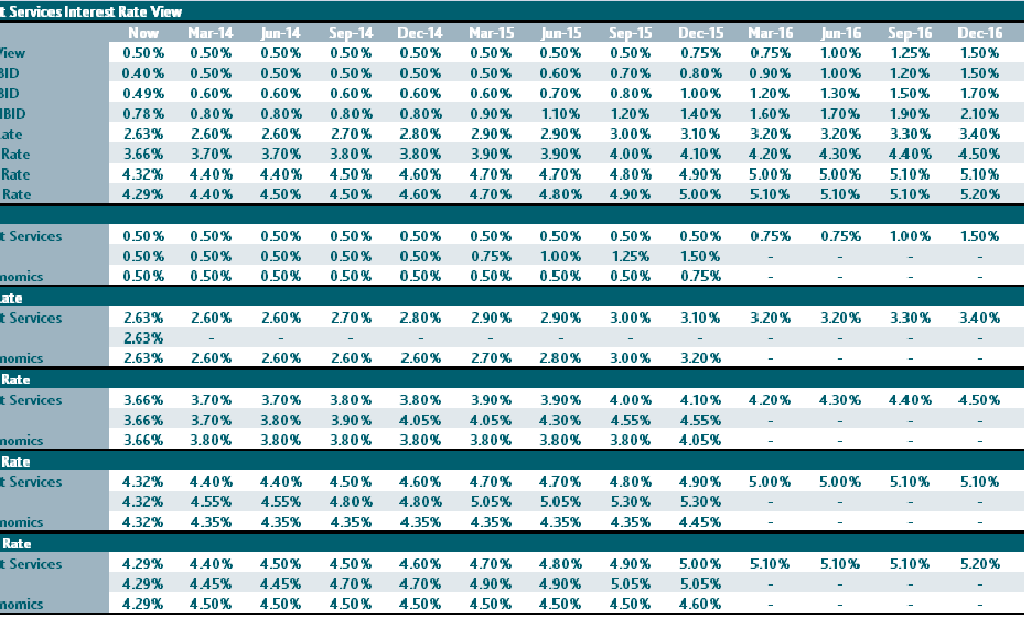

Interest rate outlook: The Bank Rate has been unchanged at 0.50% since March 2009. Budgets and cash flow forecasts have been based on the view of base rates supplied by Capita Asset Services. The Capita Asset Services view of base rate movements is provided at Appendix G.

The Commissioner will avoid locking into longer term deals while investment rates are at historically low levels. This is unless exceptionally attractive rates are available with counterparties of particularly high creditworthiness which make longer term deals worthwhile and within the risk parameters set by the Commissioner.

In terms of a temporary investments strategy, the Commissioner’s Chief Finance Officer continues to monitor the “interest rate market” to ensure that the net return/cost achieved does not diverge from the market norm (e.g. average 7-day rate), whilst maintaining the appropriate security of principal invested.

A mixture of short term and longer period investments will be made in response to:-

- Day-to-day cash flow requirements;

- Medium to longer term cash flow requirements;

- Capital and Revenue Development Programme;

- Property & Facilities Strategy (Major 5 year investment programme);

- The relationship between short term and longer period rates in conjunction with market expectations and forecasts.

The day-to-day cash flow will continue to be carefully monitored throughout the year. Each working day any surplus funds will be invested on the short-term money market, whilst any shortfall will be borrowed from the same source.

The Medium Term Financial Plan (MTFP) includes a fully funded Capital and Revenue Development Programme covering the period 2014/15 to 2017/18 and indicates that no new external borrowing is required to support the current capital expenditure plans until 2015/16 when £2.9m may be taken.

The Commissioner should be aware that the options for funding of future investment beyond those detailed in the MTFP will be restricted to:-

- re-allocation of resources from projects currently identified in the MTFP;

- increased contributions from revenue;

- borrowing.

The Funding and Financial strategies provide the governance environment in which financial business is undertaken. These strategies together will enable both the Commissioner and the Chief Constable to identify the alternative funding options and their impact on the revenue budget and associated asset base. In turn, this will aid in mitigating the risks that are faced in the medium term, whilst building a sustainable funding platform, through following a structured approach to evaluating funding options.

Treasury indicators which limit risk and activity – ‘Prudential Indicators’

It is a statutory duty under Section 3 of the Act and supporting regulations for the Commissioner to determine and keep under review how much the organisation can afford to borrow. The amount so determined is termed the “Affordable Borrowing Limit”. In England and Wales the Authorised Limit represents the legislative limit specified in the Act.

The Commissioner must have regard to the Prudential Code when setting the Authorised Limit, which essentially requires it to ensure that total capital investment remains within sustainable limits and, in particular, that the impact upon its future precept levels is ‘acceptable’.

Whilst termed an “Affordable Borrowing Limit”, the capital plans to be considered for inclusion incorporate financing by both external borrowing and other forms of liability, such as credit arrangements. The Authorised Limit is to be set, on a rolling basis, for the forthcoming financial year and two successive financial years. Details of the Authorised Limit can be found in Appendix 3 of this report.

Prudential and Treasury Indicators 2014/15-2017/18

As well as being required by statute, the Prudential and Treasury indicators set out at Appendix 3 are relevant for the purposes of formulating an integrated treasury management strategy and ensuring appropriate measures are in place to support the Business Development Plan.

The required Prudential Indicators for the forthcoming and at least the subsequent two financial years must be set by the Commissioner before the start of the financial year. They may, however, be revised at any time if circumstances change. They may take the form of upper/lower limits, estimates or actual figures, and may comprise a mixture of three year estimates/limits, actuals for the previous year and treasury management indicators relating to compliance and upper lending limits.

The Indicators must be consistent with proper accounting practice and, where applicable, reconcile ultimately with figures in the published statement of accounts (actual results), revenue budget and/or capital plan (budgets). They are designed to support local decision making and not to be comparative performance indicators. They should therefore be seen as defining an integrated and complete picture of prudential financial management in relation to capital expenditure and treasury management, not as a set of individual indicators to be assessed in isolation.

Factors to be taken into account in setting or revising the Prudential Indicators include affordability (e.g. precept setting implications), prudence and sustainability (e.g. the implications of external borrowing), value for money (e.g. option appraisal), stewardship of assets (e.g. asset management planning), service objectives (e.g. strategic planning) and practicality (e.g. achievability of the Capital Plan).

CIPFA’s Prudential Code for Capital Finance in Local Authorities has recently been amended to include a new indicator. The indicator shows the actual external debt (the treasury management operations), as a percentage of the underlying capital borrowing need (the Capital Financing Requirement – CFR), highlighting any over or under borrowing.

The CFO can report that the Authorised Limits for external debt is consistent with the Commissioner’s current commitments, the existing capital plan, the capital expenditure forecasts and associated revenue budget implications identified in the budget report for 2014/15 and the approved Treasury Management Policy Statement.

The Chief Finance Officer also confirms that the limits are based on the estimate of most likely, prudent, but not worst case scenario, with sufficient headroom over and above this to allow for operational management (e.g. unusual cash movement). To derive these limits, a risk analysis has been applied to the capital plan, estimates of the capital financing requirement and estimates of cashflow requirements for all purposes.

Having made her decision on the Revenue Budget, the Commissioner is now asked to note that the “Authorised Limit” determined for 2014/15, will be the statutory limit determined under section 3(1) of the Local Government Act 2003.

Economic Background

Prospects for Interest Rates and Economic Considerations

Capita Asset Services Treasury Services act as the Commissioner’s treasury advisors and part of their service is to assist in formulating a view on interest rates. The table in Appendix G draws together a number of current City forecasts for short term (Bank Rate) and longer fixed interest rates. Capita Asset Services’s central view is as follows:

| Annual Average % | Bank Rate % | PWLB Borrowing Rates % (including certainty rate adjustment) | ||

|---|---|---|---|---|

| 5 year | 25 year | 50 year | ||

| Mar 2014 | 0.50 | 2.50 | 4.40 | 4.40 |

| Jun 2014 | 0.50 | 2.60 | 4.50 | 4.50 |

| Sep 2014 | 0.50 | 2.70 | 4.50 | 4.50 |

| Dec 2014 | 0.50 | 2.70 | 4.60 | 4.60 |

| Mar 2015 | 0.50 | 2.80 | 4.60 | 4.70 |

| Jun 2015 | 0.50 | 2.80 | 4.70 | 4.80 |

| Sep 2015 | 0.50 | 2.90 | 4.80 | 4.90 |

| Dec 2015 | 0.50 | 3.00 | 4.90 | 5.00 |

| Mar 2016 | 0.50 | 3.10 | 5.00 | 5.10 |

| Jun 2016 | 0.75 | 3.20 | 5.10 | 5.20 |

| Sep 2016 | 1.00 | 3.30 | 5.10 | 5.20 |

| Dec 2016 | 1.00 | 3.40 | 5.10 | 5.20 |

| Mar 2017 | 1.25 | 3.40 | 5.10 | 5.20 |

There is downside risk to these forecasts if recovery from the recession proves to be weaker and slower than currently expected.

THE UK ECONOMY

Economic growth. Until 2013, the economic recovery in the UK since 2008 had been the worst and slowest recovery in recent history. However, growth strongly rebounded in 2013 – quarter 1 (+0.3%), 2 (+0.7%) and 3 (+0.8%), to surpass all expectations as all three main sectors, services, manufacturing and construction contributed to this strong upturn. The Bank of England has, therefore, upgraded growth forecasts in the August and November quarterly Inflation Reports for 2013 from 1.2% to 1.6% and for 2014 from 1.7% to 2.8%, (2015 unchanged at 2.3%). The November Report stated that: –

In the United Kingdom, recovery has finally taken hold. The economy is growing robustly as lifting uncertainty and thawing credit conditions start to unlock pent-up demand. But significant headwinds — both at home and abroad — remain, and there is a long way to go before the aftermath of the financial crisis has cleared and economic conditions normalise. That underpins the MPC’s intention to maintain the exceptionally stimulative stance of monetary policy until there has been a substantial reduction in the degree of economic slack. The pace at which that slack is eroded, and the durability of the recovery, will depend on the extent to which productivity picks up alongside demand. Productivity growth has risen in recent quarters, although unemployment has fallen by slightly more than expected on the back of strong output growth.

Forward surveys are currently very positive in indicating that growth prospects are also strong for 2014, not only in the UK economy as a whole, but in all three main sectors, services, manufacturing and construction. This is very encouraging as there does need to be a significant rebalancing of the economy away from consumer spending to construction, manufacturing, business investment and exporting in order for this start to recovery to become more firmly established. One drag on the economy is that wage inflation continues to remain significantly below CPI inflation so disposable income and living standards are under pressure, although income tax cuts have ameliorated this to some extent. This therefore means that labour productivity must improve significantly for this situation to be corrected by the warranting of increases in pay rates.

Forward guidance. The Bank of England issued forward guidance in August which stated that the Bank will not start to consider raising interest rates until the jobless rate (Labour Force Survey / ILO i.e. not the claimant count measure) has fallen to 7% or below. This would require the creation of about 750,000 jobs and was forecast to take three years in August, but revised to possibly quarter 4 2014 in November. The UK unemployment rate has already fallen to 7.4% on the three month rate to October 2013 (although the rate in October alone was actually 7.0%). The Bank’s guidance is subject to three provisos, mainly around inflation; breaching any of them would sever the link between interest rates and unemployment levels. This actually makes forecasting Bank Rate much more complex given the lack of available reliable forecasts by economists over a three year plus horizon. The recession since 2007 was notable for how unemployment did NOT rise to the levels that would normally be expected in a major recession and the August Inflation Report noted that productivity had sunk to 2005 levels. There has, therefore, been a significant level of retention of labour, which will mean that there is potential for a significant amount of GDP growth to be accommodated without a major reduction in unemployment. However, it has been particularly encouraging that the strong economic growth in 2013 has also been accompanied by a rapid increase in employment and forward hiring indicators are also currently very positive. It is therefore increasingly likely that early in 2014, the MPC will need to amend its forward guidance by reducing its 7.0% threshold rate and/or by adding further wording similar to the Fed’s move in December (see below).

Credit conditions. While Bank Rate has remained unchanged at 0.5% and quantitative easing has remained unchanged at £375bn in 2013, the Funding for Lending Scheme (FLS) was extended to encourage banks to expand lending to small and medium size enterprises. The second phase of Help to Buy aimed at supporting the purchase of second hand properties, will also start in earnest in January 2014. These measures have been so successful in boosting the supply of credit for mortgages, and so of increasing house purchases, (though levels are still far below the pre-crisis level), that the Bank of England announced at the end of November that the FLS for mortgages would end in February 2014. While there have been concerns that these schemes are creating a bubble in the housing market, house price increases outside of London and the south-east have been much weaker. However, bank lending to small and medium enterprises continues to remain weak and inhibited by banks still repairing their balance sheets and anticipating tightening of regulatory requirements.

Inflation. Inflation has fallen from a peak of 3.1% in June 2013 to 2.1% in November. It is expected to remain near to the 2% target level over the MPC’s two year time horizon.

AAA rating. The UK has lost its AAA rating from Fitch and Moody’s but that caused little market reaction.

THE GLOBAL ECONOMY

The Eurozone (EZ). The sovereign debt crisis has eased considerably during 2013 which has been a year of comparative calm after the hiatus of the Cyprus bailout in the spring. In December, Ireland escaped from its three year EZ bailout programme as it had dynamically addressed the need to substantially cut the growth in government debt, reduce internal price and wage levels and promote economic growth. The EZ finally escaped from seven quarters of recession in quarter 2 of 2013 but growth is likely to remain weak and so will dampen UK growth. The ECB’s pledge to buy unlimited amounts of bonds of countries which ask for a bail out has provided heavily indebted countries with a strong defence against market forces. This has bought them time to make progress with their economies to return to growth or to reduce the degree of recession. However, debt to GDP ratios (2012 figures) of Greece 176%, Italy 131%, Portugal 124%, Ireland 123% and Cyprus 110%, remain a cause of concern, especially as many of these countries are experiencing continuing rates of increase in debt in excess of their rate of economic growth i.e. these debt ratios are continuing to deteriorate. Any sharp downturn in economic growth would make these countries particularly vulnerable to a new bout of sovereign debt crisis. It should also be noted that Italy has the third biggest debt mountain in the world behind Japan and the US. Greece remains particularly vulnerable and continues to struggle to meet EZ targets for fiscal correction. Whilst a Greek exit from the Euro is now improbable in the short term, as Greece has made considerable progress in reducing its annual government deficit and a return towards some economic growth, some commentators still view an eventual exit as being likely. There are also concerns that austerity measures in Cyprus could also end up in forcing an exit. The question remains as to how much damage an exit by one country would do and whether contagion would spread to other countries. However, the longer a Greek exit is delayed, the less are likely to be the repercussions beyond Greece on other countries and on EU banks.

Sentiment in financial markets has improved considerably during 2013 as a result of firm Eurozone commitment to support struggling countries and to keep the Eurozone intact. However, the foundations to this current “solution” to the Eurozone debt crisis are still weak and events could easily conspire to put this into reverse. There are particular concerns as to whether democratically elected governments will lose the support of electorates suffering under EZ imposed austerity programmes, especially in countries like Greece and Spain which have unemployment rates of over 26% and unemployment among younger people of over 50%. The Italian political situation is also fraught with difficulties in maintaining a viable coalition which will implement an EZ imposed austerity programme and undertake overdue reforms to government and the economy. There are also concerns over the lack of political will in France to address issues of poor international competitiveness,

USA. The economy has managed to return to robust growth in Q2 2013 of 2.5% y/y and 4.1% y/y in Q3, in spite of the fiscal cliff induced sharp cuts in federal expenditure that kicked in on 1 March, and increases in taxation. The Federal Reserve therefore decided in December to reduce its $85bn per month asset purchases programme of quantitative easing by $10bn. It also amended its forward guidance on its pledge not to increase the central rate until unemployment falls to 6.5% by adding that there would be no increases in the central rate until ‘well past the time that the unemployment rate declines below 6.5%, especially if projected inflation continues to run below the 2% longer run goal’. Consumer, investor and business confidence levels have all improved markedly in 2013. The housing market has turned a corner and house sales and increases in house prices have returned to healthy levels. Many house owners have, therefore, been helped to escape from negative equity and banks have also largely repaired their damaged balance sheets so that they can resume healthy levels of lending. All this portends well for a reasonable growth rate looking forward.

China. There are concerns that Chinese growth could be on an overall marginal downward annual trend. There are also concerns that the new Chinese leadership have only started to address an unbalanced economy which is heavily dependent on new investment expenditure, and for a potential bubble in the property sector to burst, as it did in Japan in the 1990s, with its consequent impact on the financial health of the banking sector. There are also concerns around the potential size, and dubious creditworthiness, of some bank lending to local government organisations and major corporates. This primarily occurred during the government promoted expansion of credit, which was aimed at protecting the overall rate of growth in the economy after the Lehmans crisis.

Japan. The initial euphoria generated by “Abenomics”, the huge QE operation instituted by the Japanese government to buy Japanese debt, has tempered as the follow through of measures to reform the financial system and the introduction of other economic reforms, appears to have stalled. However, at long last, Japan has seen a return to reasonable growth and positive inflation during 2013 which augurs well for the hopes that Japan can escape from the bog of stagnation and deflation and so help to support world growth. The fiscal challenges though are huge; the gross debt to GDP ratio is about 245% in 2013 while the government is currently running an annual fiscal deficit of around 50% of total government expenditure. Within two years, the central bank will end up purchasing about Y190 trillion (£1,200 billion) of government debt. In addition, the population is ageing due to a low birth rate and, on current trends, will fall from 128m to 100m by 2050.

CAPITA ASSET SERVICES FORWARD VIEW

Economic forecasting remains difficult with so many external influences weighing on the UK. Major volatility in bond yields is likely to endure as investor fears and confidence ebb and flow between favouring more risky assets i.e. equities, and safer bonds.

There could well be volatility in gilt yields over the next year as financial markets anticipate further tapering of asset purchases by the Fed. The timing and degree of tapering could have a significant effect on both Treasury and gilt yields. Equally, while the political deadlock and infighting between Democrats and Republicans over the budget has almost been resolved the raising of the debt limit, has only been kicked down the road. A final resolution of these issues could have a significant effect on gilt yields during 2014.

The longer run trend is for gilt yields and PWLB rates to rise, due to the high volume of gilt issuance in the UK, and of bond issuance in other major western countries. Increasing investor confidence in economic recovery is also likely to compound this effect as a continuation of recovery will further encourage investors to switch back from bonds to equities.

The overall balance of risks to economic recovery in the UK is currently evenly weighted. However, only time will tell just how long this period of strong economic growth will last; it also remains exposed to vulnerabilities in a number of key areas.

The interest rate forecasts in this report are based on an initial assumption that there will not be a major resurgence of the EZ debt crisis, or a break-up of the EZ, but rather that there will be a managed, albeit painful and tortuous, resolution of the debt crisis where EZ institutions and governments eventually do what is necessary – but only when all else has been tried and failed. Under this assumed scenario, growth within the EZ will be tepid for the next couple of years and some EZ countries experiencing low or negative growth, will, over that time period, see a significant increase in total government debt to GDP ratios. There is a significant danger that these ratios could rise to the point where markets lose confidence in the financial viability of one, or more, countries. However, it is impossible to forecast whether any individual country will lose such confidence, or when, and so precipitate a resurgence of the EZ debt crisis. While the ECB has adequate resources to manage a debt crisis in a small EZ country, if one, or more, of the large countries were to experience a major crisis of market confidence, this would present a serious challenge to the ECB and to EZ politicians.

Downside risks currently include:

- UK strong economic growth is currently very dependent on consumer spending and recovery in the housing market. This is unlikely to endure much beyond 2014 as most consumers are maxed out on borrowing and wage inflation is less than CPI inflation, so disposable income is being eroded.

- A weak rebalancing of UK growth to exporting and business investment causing a major weakening of overall economic growth beyond 2014

- Weak growth or recession in the UK’s main trading partners – the EU and US, depressing economic recovery in the UK.

- Prolonged political disagreement over the raising of the US debt ceiling.

- A return to weak economic growth in the US, UK and China causing major disappointment in investor and market expectations.

- A resurgence of the Eurozone sovereign debt crisis caused by ongoing deterioration in government debt to GDP ratios to the point where financial markets lose confidence in the financial viability of one or more countries and in the ability of the ECB and Eurozone governments to deal with the potential size of the crisis.

- The potential for a significant increase in negative reactions of populaces in Eurozone countries against austerity programmes, especially in countries with very high unemployment rates e.g. Greece and Spain, which face huge challenges in engineering economic growth to correct their budget deficits on a sustainable basis.

- The Italian political situation is frail and unstable; this will cause major difficulties in implementing austerity measures and a programme of overdue reforms. Italy has the third highest government debt mountain in the world.

- Problems in other Eurozone heavily indebted countries (e.g. Cyprus and Portugal) which could also generate safe haven flows into UK gilts, especially if it looks likely that one, or more countries, will need to leave the Eurozone.

- A lack of political will in France, (the second largest economy in the EZ), to dynamically address fundamental issues of low growth, poor international uncompetitiveness and the need for overdue reforms of the economy.

- Monetary policy action failing to stimulate sustainable growth in western economies, especially the Eurozone and Japan.

- Geopolitical risks e.g. Syria, Iran, North Korea, which could trigger safe haven flows back into bonds.

The potential for upside risks to UK gilt yields and PWLB rates, especially for longer term PWLB rates include: –

- A sharp upturn in investor confidence that sustainable robust world economic growth is firmly expected, causing a surge in the flow of funds out of bonds into equities.

- A reversal of Sterling’s safe-haven status on a sustainable improvement in financial stresses in the Eurozone.

- UK inflation being significantly higher than in the wider EU and US, causing an increase in the inflation premium inherent to gilt yields.

- In the longer term – an earlier than currently expected reversal of QE in the UK; this could initially be implemented by allowing gilts held by the Bank to mature without reinvesting in new purchases, followed later by outright sale of gilts currently held.

Borrowing Strategy

The Commissioner currently only has one loan with North Yorkshire County Authority, which is repayable in annual instalments and will be repaid on 31 March 2015. The interest rate is fixed at 9.15% and a grant of 51% is received towards the principal and interest costs. There is no intention to replace this loan while the grant contribution continues.

The Capita Asset Services forecast for the PWLB new borrowing rate, including the 20 basis points certainty rate reduction in November 2012, are included in Appendix G

In view of the forecast, should borrowing be required at any stage, the Commissioner’s borrowing strategy will be based upon the following:

- If rates are expected to increase during the year it would be advantageous to time new long term borrowing as soon as the requirement is known.

- PWLB rates on loans of less than ten years duration are expected to be lower than longer term PWLB rates offering a range of options for new borrowing which will spread debt maturities away from a concentration in long dated debt.

- Consideration will also be given to borrowing fixed rate market loans at 25 – 50 basis points below the PWLB target rate and to maintaining an appropriate balance between PWLB and market debt in the debt portfolio.

In normal circumstances the main sensitivities of the forecast are likely to be the two scenarios noted below. The treasury officers, in conjunction with the treasury advisers, will continually monitor both the prevailing interest rates and the market forecasts, adopting the following responses (as set out in the Treasury Management Policy) to a change of sentiment:

- if it were felt that there was a significant risk of a sharp FALL in long and short term rates, e.g. due to a marked increase of risks around relapse into recession or of risks of deflation, then long term borrowings will be postponed, and potential rescheduling from fixed rate funding into short term borrowing will be considered;

- if it were felt that there was a significant risk of a much sharper RISE in long and short term rates than that currently forecast, perhaps arising from a greater than expected increase in world economic activity or a sudden increase in inflation risks, then the portfolio position will be re-appraised with the likely action that fixed rate funding will be drawn whilst interest rates were still relatively cheap.

An impact assessment will be incorporated as part of the decision making process for accessing borrowing facilities. This assessment will incorporate consideration of interest rates, maturity periods and loan types available to secure value for money for the Commissioner. Borrowing will only be considered as a matter of need. It will not be in anticipation of that need.

It is not anticipated that there will be a need to re-schedule existing outstanding debt, but should there be a future need this would be in accordance with the policy on maturity profiles and only where overall savings can be achieved.

Contribution to Police and Crime Plan outcomes

The requirement for production and monitoring of Prudential and Treasury Indicators ensures the Commissioner prudently manages the alternative funding streams available to it to maintain an affordable and sustainable Business Development Plan (BDP). Although there is no direct impact on the Police and Crime Plan, effective Treasury Management ensures that the financial infrastructure is appropriate to underpin the resources available to deliver the service required.

The Medium Term Financial Plan (MTFP), version 43, presented to the Commissioner as part of the budget report, indicates that no new borrowing is required to support the current capital expenditure plans until 2015/16 when £2.9m may be taken to support the capital programme.

Creditworthiness Policy

The Commissioner uses the creditworthiness service provided by Capita Asset Services. This service uses a sophisticated modelling approach with credit ratings from all three rating agencies, Fitch, Moodys and Standard and Poors, forming the core element. However, it does not rely solely on the current credit ratings of counterparties but also uses the following as overlays: –

- credit watches and credit outlooks from credit rating agencies;

- specific economic indices to give early warning of likely changes in credit ratings;

- sovereign ratings to select counterparties from only the most creditworthy countries.

This modelling approach combines credit ratings, credit watches and credit outlooks in a weighted scoring system which is then combined with an overlay of specific economic indices for which the end product is a series of colour code bands which indicate the relative creditworthiness of counterparties. These colour codes are also used to determine the duration for investments and are therefore referred to as durational bands. The Commissioner’s Chief Finance Officer is satisfied that this is a service which the office of the Police and Crime Commissioner would not currently be able to replicate using in house resources.

The selection of counterparties with a high level of creditworthiness will be achieved by selection of institutions down to a minimum durational band within Capita Asset Services’s weekly credit list of worldwide potential counterparties. The Commissioner will therefore use counterparties within the following durational bands: –

- Purple 2 years

- Blue 1 year (only applies to nationalised or semi nationalised UK Banks)

- Orange 1 year

- Red 6 months

- Green 3 months

The Commissioner will not use the approach suggested by CIPFA of using the lowest rating from all three rating agencies to determine creditworthy counterparties as Moodys tend to be more aggressive in giving low ratings than the other two agencies. This would be unworkable and leave the very few parties on the approved lending list. The Capita Asset Services creditworthiness service does use ratings from all three agencies, but by using a risk weighted scoring system does not overly rely on one agency’s ratings.

All credit ratings are monitored via daily bulletins received from Capita Asset Services. The Treasury function is alerted to changes to ratings of all three agencies through its use of the Capita Asset Services creditworthiness service.

If a downgrade results in the counterparty/investment scheme no longer meeting the Commissioner’s minimum criteria, its further use as a new investment will be withdrawn immediately.

In addition to the use of Credit Ratings the Commissioner is advised of information in movements in benchmarks and other market data on a weekly basis. Extreme market movements may result in downgrade of an institution or removal from the Commissioner’s lending list.

Sole reliance will not be placed on the use of this external service. In addition the Commissioner will also use market data and market information, information on government support for banks and the credit ratings of that government support.

Appendix B

Treasury Management Policy Statement

The proposed Treasury Policy Statement, based upon CIPFA guidance, is as follows:

Treasury management activities are defined as:

The management of the Commissioner’s investments and cash flows, banking, money market and capital market transactions; the effective control of the risks associated with those activities. The key principles underpinning treasury management activities are as follows:

- The Commissioner regards the successful identification, monitoring and control of work as the main criteria by which the effectiveness of treasury management activities is measured. Accordingly the analysis and reporting of the treasury management activities will focus on their risk implications for the organisation, and any financial instruments entered into, to manage these risks.

- The Commissioner acknowledges that effective treasury management will provide support towards the achievement of business and service objectives. The Commissioner is committed to the principles of achieving value for money in treasury management, and to employing suitable comprehensive performance measurement techniques, within the context of effective risk management.

The Commissioner’s high level policies for borrowing and investments are:

Borrowing

If it were felt that there was a significant risk of a sharp FALL in long and short term rates, e.g. due to a marked increase of risks around relapse into recession or of risks of deflation, then long term borrowings will be postponed, and potential rescheduling from fixed rate funding into short term borrowing will be considered.

If it were felt that there was a significant risk of a much sharper RISE in long and short term rates than that currently forecast, perhaps arising from a greater than expected increase in world economic activity or a sudden increase in inflation risks, then the portfolio position will be re-appraised with the likely action that fixed rate funding will be drawn whilst interest rates were still relatively cheap.

Investments

The Commissioner’s investment strategy has as its primary objective safeguarding the repayment of the principal and interest of its investments on time first, with ensuring adequate liquidity second and investment return third. In the current economic climate the overriding risk consideration relates to counter party security. The Commissioner will continue to favour quality counter parties when placing funds, even if this involves a yield sacrifice.

Appendix C

Treasury indicators which limit risk and activity – ‘Prudential Indicators’

| Treasury Indicators | 2013/14 Estimate £’000 | 2014/15 Budget £’000 | 2015/16 MTFP v43 £’000 | 2016/17 MTFP v43 £’000 | 2017/18 MTFP v43 £’000 |

|---|---|---|---|---|---|

| Gross external debt | 235.4 | 2,850.2 | 11,918.4 | 11,647.7 | |

| Investments | (34,301.2) | (25,796.2) | (14,653.2) | (11,957.2) | (14,561.5) |

| Net borrowing (investment) | (34,065.8) | (25,796.2) | (11,803.0) | (38.8) | (2,913.8) |

| Prudential Indicators | |||||

| Authorised limit for external debt | 3,235.4 | 3,000.0 | 5,850.2 | 18,753.4 | 15,142.0 |

| Operational boundary for external debt | 235.4 | 0 | 2,850.2 | 14,425.7 | 11,647.7 |

| Capital expenditure | 12,882.6 | 11,100.3 | 17,694.0 | 18,091.7 | 8,091.0 |

| Capital Financing Requirement (CFR) | 586.6 | 351.2 | 3,201.4 | 14,776.9 | 11,998.9 |

| Annual change in CFR | (235.4) | (235.4) | 2,850.2 | 11,575.5 | (2,778.0) |

| In year borrowing (investment) requirement | (34,065.8) | (25,796.2) | (11,803.0) | (38.8) | (2,913.8) |

| Ratio of financing costs to net revenue stream | 0.00% | 0.04% | 0.01% | 0.52% | 0.51% |

Appendix D

Annual Investment Strategy

- The Commissioner will have regard to the CLG’s Guidance on Local Government Investments (“the Guidance”) and the 2011 revised CIPFA Treasury Management in Public Services Code of Practice and Cross Sectoral Guidance Notes (“the CIPFA TM Code”). The Commissioner’s investment priorities are:

- the security of capital; and

- the liquidity of its investments

- The Commissioner will also aim to achieve the optimum return on investments commensurate with proper levels of security and liquidity. The Commissioner’s risk appetite is low in order to give priority to security of investments.

- The borrowing of monies purely to invest or on‑lend and make a return is unlawful and the Commissioner will not engage in such activity.

- Investment instruments are identified as either ‘Specified’ or ‘Non-Specified’ Investments. The Commissioner’s available instruments are listed in paragraph below. Counterparty limits will be as set through the Treasury Management Practices.

- It is proposed that the Annual Investment Strategy for 2013/14 is based solely upon the use of “specified” investments listed below, with all such investments being sterling denominated, with maturities up to a maximum of 364 days (<12 months) meeting the minimum “high” credit rating where applicable:

- Debt Management Agency Deposit Facility

- Term Deposits – UK Government

- Term Deposits – other local authorities

- Term Deposits – banks and building societies

- Money market funds

- It should be noted that the Commissioner has adopted a policy to allow placing of investments up to a period of 546 days. However, this facility was not required during the current financial year, with all investments intended to be placed for periods of up to 364 days, and with UK financial institutions only. A summary of the current investment periods are outlined below with the main emphasis being on increasing the liquidity of funds by reducing the length of time any one investment should be held with a counterparty:

- The Treasury Management Function takes cognisance of latest market information produced by the treasury advisors (Capita Asset Services) to support decisions regarding maturity periods and counterparty limits.

Since the credit crunch crisis there have been a number of developments which require separate consideration and approval for use:

Part – Nationalised banks in the UK have credit ratings which do not conform to the credit criteria usually used by local authorities to identify banks which are of high credit worthiness. In particular, as they no longer are separate institutions in their own right, it is impossible for Fitch to assign them an individual rating for their stand alone financial strength. Accordingly, Fitch have assigned an “F” individual rating[1] which means that at a historical point of time, this bank failed and is now at least part owned by the Government. However, these institutions are now recipients of an “F1+” short term rating[2] as they effectively take on the creditworthiness of the Government itself i.e. deposits made with them are effectively being made to the Government. They also have a support rating of 1; in other words, on both counts, they have the highest ratings possible.

Due the current economic climate presenting significant difficulties for the treasury management function to find available counterparty’s changes were made to the approved list of counterparties or their investment limits at a Police Authority meeting in June 2012. Current limits are shown in Appendix H below.

| Sector Colour Code | Current Investment period |

|---|---|

| Green | 3 Months |

| Red | 6 Months |

| Orange | 12 Months |

| Blue | 12 months (Government Backed) |

| Purple | 24 months |

| Yellow | Up to 60 months |

Appendix E

Borrowing Requirement and Minimum Revenue Provision (MRP) Policy 2014/15

- Current forecasts show that there is sufficient capital funding to cover the capital expenditure in the capital plan without the need for any new external borrowing before 2015/16.

- The Commissioner has adopted an MRP policy in line with the main recommendations contained within the guidance issued by the Secretary of State under section 21(1A) of the Local Government Act 2003.

- The broad aim of a prudent MRP provision is to ensure that debt is repaid over a period that is reasonably commensurate with the period over which the capital expenditure (financed by the debt) provides benefits.

- For 2014/15 the Commissioner is requested to approve the continuation of the use of the Asset Life Method (equal instalments) for any borrowing made/expenditure incurred after 1 April 2008, whilst existing debt prior to that date will continue to be based upon the Regulatory Method.

Appendix F

TREASURY MANAGEMENT PRACTICES

TMP1: Treasury risk management:

Credit and counterparty risk

The risk of failure of a third party to meet their contractual obligations under an investment, borrowing, capital, project or partnership financing, particularly as a result of the third party’s diminished creditworthiness.

Liquidity risk

The risk that cash will not be available when needed.

Interest rate risk

Fluctuations in the levels of interest rates create an unexpected or an unbudgeted burden on an organisation’s finances against which it has failed to protect itself adequately.

Exchange rate risk

The risk that fluctuations in foreign exchange rates create an unexpected or unbudgeted burden on an organisation’s finances.

Refinancing risk

The risk that maturing borrowings, capital, project or partnership financing cannot be refinanced on terms that reflect the provisions made by the organisation for those refinancing, both capital and revenue.

Legal and regulatory risk

The risk that the organisation fails to act in accordance with its powers or regulatory requirements.

Fraud, error, corruption and contingency management

The failure to employ suitable systems and procedures and to maintain effective contingency management arrangements to these ends.

Market risk

The risk that through adverse market fluctuations in the value of the principal sums an organisation invests, it’s stated policies and objectives are compromised.

TMP2: Performance measurement

The process designed to calculate the effectiveness of the portfolio’s or manager’s investment returns or borrowing costs and the application of the resulting data for the purposes of comparison with the performance of other portfolios or managers, or with recognised industry standards or market indices.

TMP3: Decision-making and analysis

Consideration of key aspects such as risk, legality, creditworthiness and competitiveness.

TMP4: Approved instruments, methods, and techniques

Consideration of the types of investment instruments the organisation is legally able to deal in and also the level of competences available within the organisation to allow effective decisions to be taken.

TMP5: Organisation, clarity and segregation of responsibilities and dealing arrangements.

Clear organisational and decision making lines, clearly laid down division of responsibilities, proper internal control procedures in place.

TMP6: Reporting requirements and management information requirements.

Covering reporting lines and frequencies.

TMP7: Budgeting, accounting, and audit arrangements

Covering manpower costs, debt and financing costs, bank and overdraft charges, brokerage commissions, external advisor’s and consultants’ costs.

TMP8: Cash and cash flow management

The preparation of cash flow management forecasts and ‘actuals’ to determine acceptable levels of cash balances, the adequacy of overdraft facilities and the optimum arrangements for investing and managing surplus cash.

TMP9: Money laundering

Making Treasury staff aware of the provisions of the Money Laundering Regulations 2007 and associated legislation such as the Terrorism Act 2000 and the Proceeds of Crime Act 2002, and ensuring (as far as possible) that adequate procedures are in place to ensure effective compliance with them.

TMP10: Staff training and qualifications

Ensuring the staff training and development regime is in place and that staff are competent to operate within a treasury environment.

TMP11: Use of external service providers

Ensuring that correct appointment and renewal procedures are followed.

TMP12: Corporate governance

The code requires a commitment to the principles of corporate governance, which will embrace the TPS itself, treasury policies, procedural guidelines and defined responsibilities, dealings with counter parties and external bodies.

Appendix G

Interest Rate Forecasts – provided by Capita Asset Services

Appendix H

Current Approved Counterparties and Limits

| Institution | Capita Asset Services Rating | Limit |

|---|---|---|

| Lloyds TSB Bank Plc | B – 12 months | 8,750,000 |

| Bank of Scotland Plc | B – 12 months | 8,750,000 |

| The Royal Bank of Scotland Plc | B – 12 months | 8,750,000 |

| National Westminster Bank Plc | B – 12 months | 8,750,000 |

| HSBC Bank plc | O – 12 months | 8,750,000 |

| Barclays Bank plc | G – 100 days | 8,750,000 |

| Nationwide BS | G – 100 days | 8,750,000 |

| Debt Management Office | Y – 60 months | 10,000,000 |

In the event that funds need to be invested and there are insufficient counter party limits available, the Debt Management Office counter party limit can be exceeded on the authority of the Chief Constable’s Chief Finance Officer or the Commissioner’s Chief Finance Officer.

- Published on